Contents:

With this investment option, you don’t buy or own physical gold, but you get exposure to the performance of gold in the market. With the evolution of technology, many new-age Fintechs are now providing innovative options to invest in gold. Hence, gold can now be bought and sold or invested in multiple forms (physical gold, gold bonds, digital gold, etc.). This article takes you through various investment options you can explore for investing in gold.

Select the amount you want to sell and enter bank account details where you want the money to credit. Besides, it offers round-the-clock access to your account so that you can buy or sell anytime. Sovereign Gold Bonds are issued by the Reserve Bank of India. They are issued in the multiples of 1gm and a particular investor can buy upto 4 kg.

Most people prefer storing gold in bank lockers, which require you to pay annual fee. Apart from this, there are also things like making charges and purity of gold that you should be careful about when buying physical gold. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Issued by the Reserve Bank of India, Gold Sovereign Bonds are one of the best ways to invest in digital gold.

On the other hand, when we talk about different types of investments, like investing in the stock market, it also goes down as individuals start selling their shares out of fear. Sovereign Gold Bonds do not have any visible expenses primarily because they are a derivative product guaranteed by the Government of India and not backed by physical gold. In fact, there is currently a Rs. 50 per gram discount for online purchase of these sovereign bonds.

Tax Rates for Gold Investments

4) No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account. There are various kinds of investors and individuals are always attempting to find ways of diversifying their investment portfolios. Others may wish to strike a balance between fairly decent returns and safety in investments. Still others may be daring enough to take their chances with stocks.

However, typically this secondary market features low volumes, so you might have to sell your bonds at a discount as compared to the market price of Gold. Let’s discuss these aspects of Gold investment options in detail starting with risk. If you are searching for where to buy gold online, Sovereign Gold Bond is also an excellent option.

Investing in gold? 4 things to know first – CBS News

Investing in gold? 4 things to know first.

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

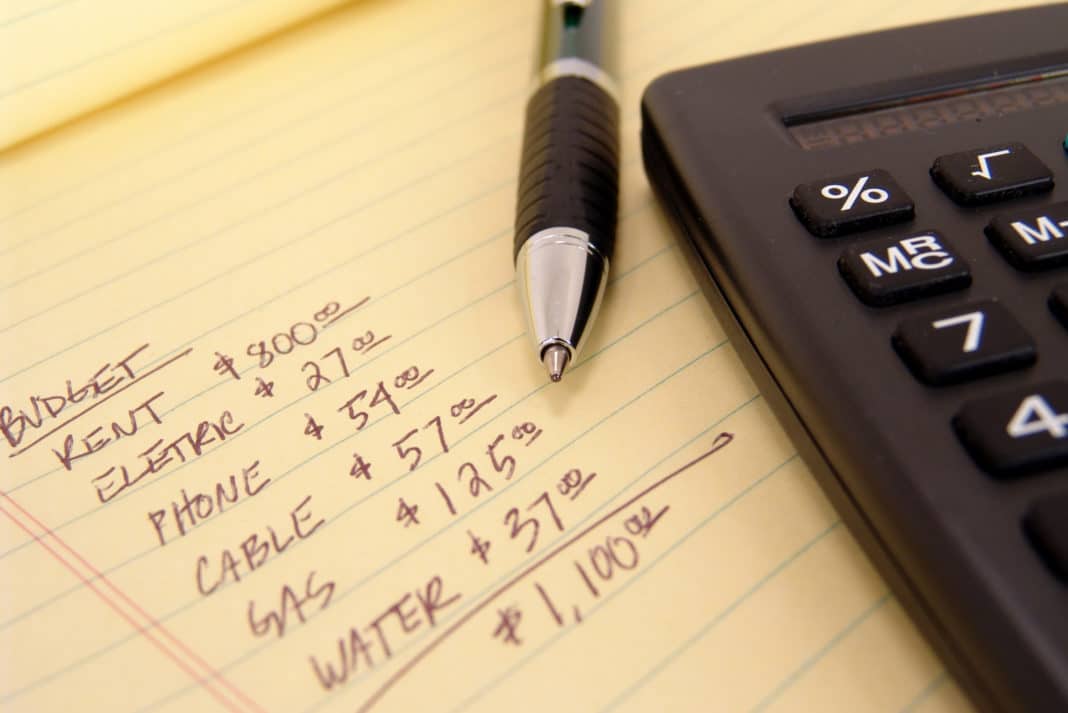

You can invest in gold either by buying physical gold or buying gold indirectly in the form of gold Mutual Funds or gold ETFs. Equity investments are ideal for long-term goals since they have the potential to generate a significant corpus. However, it is important to note that equity investments are risky compared to other debt and fixed-income assets. Here you need to start categorizing your income and expenses, budgeting them, and allocating some of your income towards investments or savings. Explore the various types of investment products available and analyze their suitability for your goals.

Gold Banking Landing Page

Those who caught the prices of gold just when they began rising would be more advantageous than those who have entered later. Offered by the National Spot Exchange Ltd , e-gold can be bought by setting up a trading account with an authorised participant with NSEL. Each unit of e-gold is equivalent to one gram of physical gold and is held in the demat account.

It is a joint venture between the Indian public sector unit MMTC and Switzerland-based PAMP-SA. Buying and selling of Gold ETFs can happen on the stock exchange with the help of a Demat account and the broker. You can start the investment with as minimal an amount as one gram unit. Gold ETFs can also be used as a collateral if the investor wishes to take a loan against them. The traditional way is purchasing gold jewellery from a trusted gold jewellery shop. However, one needs to be careful about the making charges, purity, safety and quality while buying.

When should you invest in gold? – CBS News

When should you invest in gold?.

Posted: Tue, 29 Nov 2022 08:00:00 GMT [source]

Since these are national exchanges, you can take delivery of the physical gold in major cities, including Mumbai, Ahmedabad, Delhi, Hyderabad, Bangalore, Chennai and Kolkata. This is the most common form in which gold is bought in India. The advantage of this form is that while you enjoy owning it, it continues to grow in value. If you are buying coins and bars, you can get them from the banks in tamper-proof covers thus ensuring purity.

Tax Saving Maximizer

Choose between Gold ETFs or SGBs on ShareIndia depending on how comfortable you are managing investments online and keep the worries of purity, security aside. Best suited for investors who expect high returns by taking calculated risks. Eliminates the risk of theft/burglary and buffers investments to changing market fluctuations. The investor buys a proportionate value of gold but not in the physical form.

You need to have a strategy to invest across all market cycles. From the above example, it is quite evident that with time on your side, you can achieve your goals effortlessly. Thus, you should concentrate on creating your financial goals and investing in them. When investing in your financial goals, you must address the most necessary ones first. To elaborate, when you start investing early, you can create a larger corpus for yourself for retirement with time on your side.

· Gold Sovereign Bonds

These schemes work like a SIP where you deposit a certain sum of money every month at a jeweller. Once the scheme expires or matures, you can purchase the gold for the invested amount. However, we recommend exercising caution with this form of investment.

While sovereign gold bonds come with a lot of benefits like they are safe as they are issued by the Reserve Bank of India and also provide interest on the investment. These bonds are offered in terms of gram at the current rate of gold and offer a fixed rate of interest. The investor receives value of gold at the rate prevalent at maturity. Investment in SGBs can be made through banks, post offices or stock exchanges. This is a long term investment and redemption at maturity is tax-free.

This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal. Though we have filed complaint with police for the safety of your money we request you to not fall prey to such fraudsters. You can check about our products and services by visiting our website You can also write to us at , to know more about products and services.

- However, all forms of gold are equally attractive for investments.

- Gold is one of the least volatile asset classes in the market.

- Under futures trading, risks are magnified and, if your calculations go awry even a little, it could lead to large losses in your portfolio.

- Although, there are phases when markets witness a fall in gold prices, it doesn’t last for long, and usually makes a steady comeback.

- The decline of paper investment leads to increase in the price of gold and hence gold is the perfect investment to make if you wish to diversify your portfolio.

SGB and Gold ETF, both paper-gold, are cost effective as there is no entry cost in SGB while costing for Gold ETF could be around 1 percent. Investing in gold is worthwhile because it is an inflation-beating investment. Over time, the return on gold investment has been in line with the rate of inflation.

Which is better direct or indirect gold?

To ensure that you continue to get regular mortgage brain, you need to invest in the right products. If you invest in gold, there is a chance that the invested funds will be blocked as gold may not provide you with continued income. It is a one-time investment and gain option which you would not require during or post your retirement. To maintain the regular expenses of your family, you must invest in instruments that will provide you regular income by way of dividends or interest. Prices of gold have been increasing since the past decade but one does not know where they would peak.

After World War II, the https://1investing.in/ standard collapsed, and the Bretton Woods Agreement replaced it. These have become a preferred choice among many as they can be liquidated with ease and smoothly converted into cash. Investing in digital gold also adds to liquidity, allows faster transaction when you are purchasing or selling. The Government of India launched the Gold Monetization Scheme in which physical gold lying idle in households can be given to the Government, which is then used for productive purposes. Such interest income and capital gains are both exempt from tax. Make sure you analyze the jeweller and their policy before you invest.

What are Sovereign Gold Bonds?

Launched at the end of 2015 under the umbrella of the Gold Monetisation Scheme, SGBs are made available during specific periods of the year, in tranches, by the Reserve Bank of India. During the periods when the Reserve Bank of India makes it available for people to invest in Sovereign Gold Bonds, the announcement of Sovereign Gold Bonds is made in newspapers via press releases. When you know the features of SGBs, you may view these as a good way to invest your money. None of the research recommendations promise or guarantee any assured, minimum or risk free return to the investors. Before making such investments, you should acquire knowledge about the monetary value of investing in each of these.

The gold exchange-traded fund are a great option for investors who want to invest in gold but without storing them. All you need is a demat account to start buying and selling gold ETF. The process works as mutual funds and you can be assured about the quality of the gold. Your gold remains safe and you don’t have to go to the market to sell it.

First, gold is an excellent conductor and has other use in the electronics and thermal sectors. This increases the value and demand of the yellow metal beyond jewellery and is a hedge against volatility and inflation. ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services. Since then, the precious metal has found its place in the financial markets. The rise of the gold standard as a monetary system used fixed quantities of gold to determine the value of money.

Thus an increase or decrease in the price of Gold impacts the performance of Gold ETFs. Gold Mutual Funds follow a Fund of Fund structure and primarily invest in Gold ETFs thus Physical Gold and stocks of Gold mining/refining companies become the underlying asset for these schemes. At present, both these financial products are regulated according to the guidelines of SEBI. Considered a hedge against inflation, gold is a highly liquid yet scarce asset, which is no one’s liability. Since there is a significant demand for gold in the market, it is a highly liquid asset.